There is no longer any doubt that we are facing a Climate Emergency, due to the high emission of greenhouse gases and the degradation of the environment. Among the alternatives to revert this scenario is the Carbon Credit. In this article we will tell you what these Credits and the Carbon Market are.

WHAT IS CARBON CREDIT

Since COP 3 (which took place in 1997), governments and companies have been seeking strategies to mitigate the climate crisis and with the creation of the Kyoto Protocol, greenhouse gas (GHG) emission targets were defined among the participating countries.

Today, this agreement is evolving into what we know as the Paris Agreement, signed by 195 countries, which will define different environmental goals for each country depending on its amount of emissions and economic capacity.

The goals are individual, however, the work is collective. Aiming at the collaboration of countries, strategies such as carbon credits are used to continue economic development while environmental preservation is also encouraged.

Thinking about GHG emissions, carbon credits emerge as a bargaining chip where companies that emit the most GHGs buy credits from those that manage to capture more, generating the Carbon Market.

The purpose of the Paris Agreement is to seek technologies aimed at a maximum volume of GHG emissions. Texts and procedures that encourage non-generation are being formalized, allowing reduction actions to be complemented by the purchase of carbon credits.

The tendency is for the credit generation process to become more restrictive, closing some types of projects and for the credit value to increase, since we will have more restrictions on generation and greater commercialization.

WHAT IS THE CARBON MARKET

The Carbon Market is the sale of carbon credits or, more technically, the sale of environmental assets linked to the non-emission and/or capture of greenhouse gases. This commercialization can be done within national or international territory.

Although the need to offset carbon is no longer a novelty, this is a market that took on new momentum after COP 26 which, after years of negotiation, finally managed to define the rules for the global instruments for operating this market, through Article 6 of the Paris Agreement.

There are two types of Carbon Market, regulated and voluntary, which will depend on each country and region.

REGULATED CARBON MARKET

The regulated carbon market is where there is a maximum GHG emission limit stipulated in an international, national or regional agreement. This regulation determines that companies that are above these limits negotiate the purchase of carbon credits with those who implemented it, putting pressure on industries and governments to take effective actions against their impacts.

Commercialization can be done both through bilateral negotiations between countries and with the involvement of the private sector.

Within the regulated market we have two trading environments: within the framework of the United Nations Framework Convention on Climate Change (UNFCCC) and the regional, national and subnational regulated carbon markets.

Among the most relevant landmarks in the regulation of the carbon market are those of the European Union – European Union Emissions Trading Scheme (EU ETS) and the CDM (Clean Development Mechanism) of the UN.

VOLUNTARY CARBON MARKET

The Voluntary Carbon Market does not stipulate a CO2 emission limit for companies. The trading of carbon credits is done on a voluntary basis, with compensation targets of zero net emissions, or net-zero, in line with market standards such as the Gold Standard for the Global Goals or Verra.

This type of marketing has been gaining strength especially as an ESG strategy for those companies that seek to be more attractive in the financial market by meeting the demand of consumers who are increasingly demanding about companies’ sustainable actions.

The Voluntary Carbon Market is so promising that the Voluntary Carbon Markets Integrity Initiative (“VCMI”) was created, a platform created to help private initiatives participate in this market.

CARBON MARKET IN BRAZIL

Today, the Carbon Market in Brazil works only on a voluntary basis since, despite the fact that Bill 528/21 establishing the Brazilian Market for Emissions Reduction (MBRE) is being processed by the chamber, there is still no approved norm that regulates the initiative.

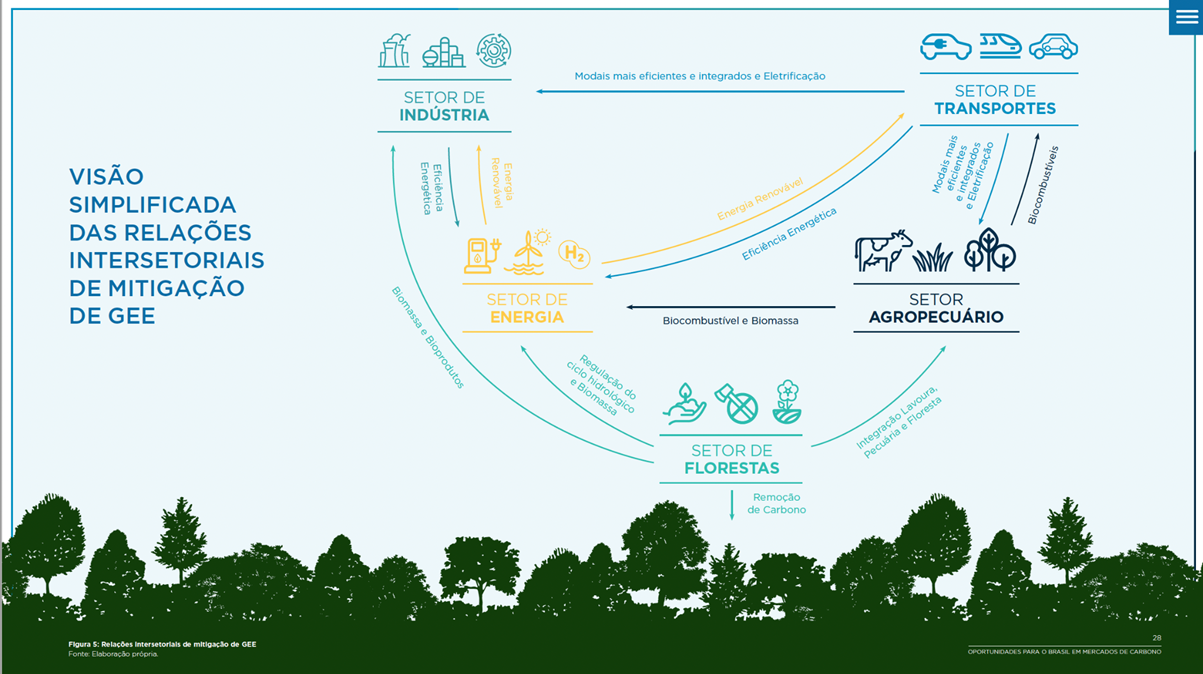

Even with just the voluntary market, Brazil has great potential for this market due to its ability to integrate solutions for the generation of carbon credits, such as forests, renewable energy from waste and the agricultural sector.

According to WayCarbon ”the most conservative possibility, with Brazil representing 3.6% of a market of 3,000 MtCO2 in 2030 and with the average price practiced from 2009 to 2018 (4.6 US$/tCO2) – would have the potential to generate US$ 493 million from the total sales of carbon credits in the country”. In a more optimistic scenario, sold carbon credits could generate up to US$ 100 billion in 2030.

The Carbon Market must and will always be connected with integral initiatives that can help regulate GHG emissions, mitigate environmental impacts and prepare governments, companies and people for the climate changes that are to come.

To find out how Orizon participates in this market, talk to an expert by clicking here.